Similar expectations of risk and returnĪll investors have similar expectations of risk and return.

#Importance of capital asset pricing model series#

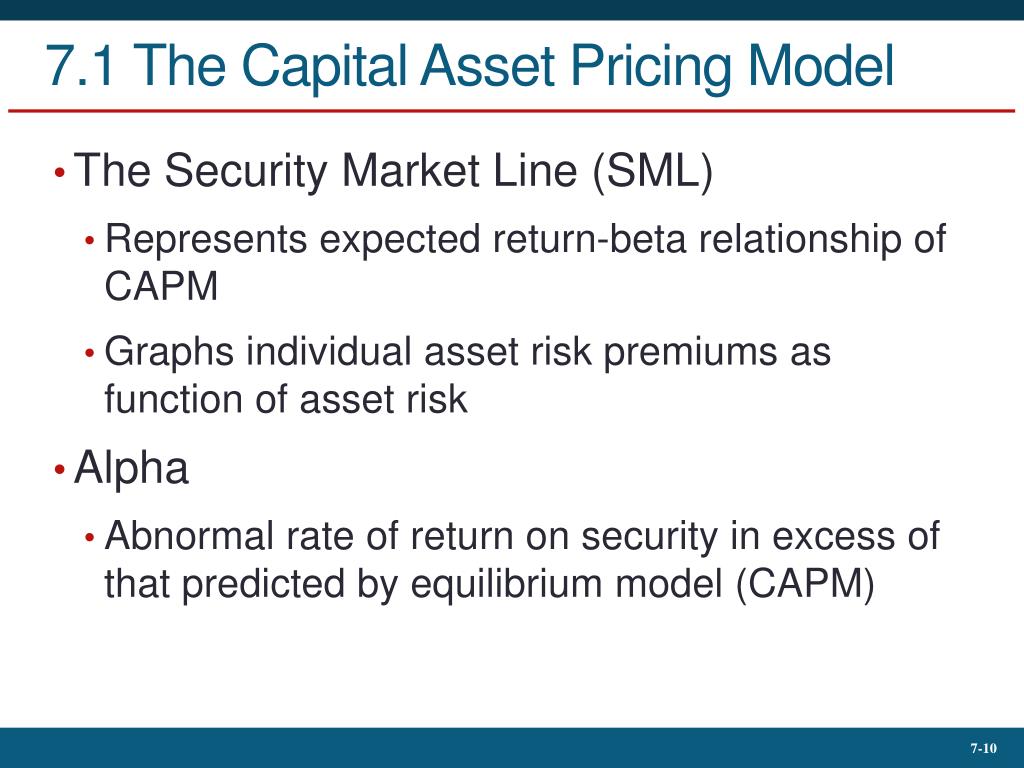

As individuals have varying perceptions towards risk and reward, CAPM gives a series of efficient frontlines.Ĥ. Some investors use the beta only to measure the risk while other investors use both beta and variance of returns as the sources of reward. But only the systematic risk remains which varies with the Beta of the security. CAPM assumes that the rational investors put away their diversifiable risk, namely, unsystematic risk. Risk and return are measured by the variance and the mean of the portfolio returns. Investors make investment decisions on the basis of risk and return.

In other words, each increment would have the same utility for him. For a risk-neutral investor, each increment in wealth is equally attractive. In such cases, each increase in wealth prompts the individual to acquire more wealth. Some investors showing a preference for larger risks are those who have increasing marginal utility for wealth. There are also other forms of utility functions. Thus, the diminishing marginal utility is most applicable to wealth. Each increment of wealth is enjoyed less than the last as each increment is less important in satisfying the basic needs of the individual. The term ‘Utility’ describes the differences in individual preferences. Maximising the utility of terminal wealthĪn investor aims at maximizing the utility of his wealth rather than the wealth or return. The investors are basically risk averse and diversification is necessary to reduce their risks. The CAPM is based on the following assumptions. Total availability of assets is fixed and assets are marketable and divisibleĪssumptions of Capital Asset Pricing Model There is risk-free asset and there is no restriction on borrowing and lending at the risk free rate Maximising the utility of terminal wealth

0 kommentar(er)

0 kommentar(er)